Your current location is:Fxscam News > Exchange Brokers

Trump warns Japan of possible 35% tariffs, rules out extension of “tariff deadline”

Fxscam News2025-07-22 20:53:15【Exchange Brokers】2People have watched

IntroductionForeign exchange platform ranking,Hong Kong's top ten foreign exchange dealers,Trump Issues Another Tariff Warning to JapanOn Tuesday, July 1, during the U.S. stock market midday

Trump Issues Another Tariff Warning to Japan

On Tuesday,Foreign exchange platform ranking July 1, during the U.S. stock market midday session, President Trump once again warned about Japan's tariff issues, expressing doubt about reaching an agreement with Japan before the "tariff deadline" on July 9. He suggested that Japan might need to pay tariffs of 30%, 35%, or whatever level the U.S. decides to impose.

Trump emphasized that the United States would not consider extending the current pause on imposing "reciprocal tariffs" beyond July 9, showing the U.S. government's tough stance on trade negotiations. Trump stated, "If there's no agreement, Japan must face these tariffs."

July 9 is a Crucial Date for the "Tariff Deadline"

In April, the U.S. announced the imposition of "reciprocal tariffs" on some countries but granted Japan a 90-day suspension, with a deadline of July 9. If the U.S. and Japan cannot reach an agreement on tariffs by the deadline, Japanese exports of cars and parts to the U.S. could face import tariffs as high as 35% or more.

This "tariff deadline" has become a critical point in U.S.-Japan trade negotiations and a significant risk event for the markets. Analysts highlight that the threat of high U.S. tariffs could affect Japanese exports in the automotive, machinery, and electronics industries and potentially disrupt the stability of global supply chains.

Yen Exchange Rate Maintains Strong Upward Trend

After Trump's speech, the dollar-yen exchange rate fell by 0.2% to 143.57, maintaining an intraday gain of about 0.2%. Although the yen has not yet returned to the low of 142.70 recorded during the European stock market session, it still demonstrates its safe-haven appeal amid rising trade risks.

Markets believe that increased U.S. trade threats to Japan might drive investors to buy yen for safety, adding pressure on the Bank of Japan and Japanese exporters in managing exchange rates.

Japan Faces Tariff Pressure and Economic Risks

If the U.S. imposes import tariffs of 30%-35% or higher on Japan, it could directly impact Japan's export-driven economy, particularly affecting the automobile industry and related parts supply chain. Japanese companies might be forced to reassess their market positioning and cost structures in the U.S.

Moreover, high tariffs could increase the retail prices of Japanese goods in the U.S., weakening the competitiveness of Japanese brands, further affecting domestic production and employment stability, and posing more uncertainties for Japan's economic recovery.

Outlook: Trade Negotiations Stalemate Could Cause Market Fluctuations

As the July 9 "tariff deadline" approaches, whether U.S.-Japan trade negotiations achieve a breakthrough will directly affect market sentiment and exchange rate fluctuations. If Trump insists on imposing high tariffs without a resolution, it could elevate global market risk aversion, leading to a stronger yen.

Investors will closely watch statements from Trump and the Japanese government, and the potential countermeasures they might adopt, while being wary of retaliatory measures and supply chain disruptions that high tariffs might provoke, adding more variables to global financial markets and Japan's economic trajectory.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(3135)

Related articles

- Market Insights: Mar 25th, 2024

- The Bitcoin price might retrace to $86,000.

- Economic outlook bleak, gold hits another milestone

- Daily Review: June 4

- UK FCA Blacklists Eight Brokers in Latest Regulatory Update

- The survey shows that the Canadian dollar may rise again in 2025.

- A brief discussion on the principles and types of forex copy trading~

- Gold and Silver Drift.

- Market Insights: Jan 29th, 2024

- The Bank of Canada has reduced the interest rate to 4.25%, marking its third consecutive cut.

Popular Articles

- 8/29 Industry Update: Belgium's FSMA warns against three new fraudulent investment platforms.

- Japan's core prices rose in July; market eyes BOJ policy changes.

- Goldman Sachs predicts that the UK will soon cut interest rates.

- The yen hit a yearly high as the market expects adjustments in central bank policies.

Webmaster recommended

Insurance giant Marsh to acquire Australian Honan Insurance Group

Gold prices near highs; US rate cuts possible. Opportunity for short sellers?

The price of gold drops below $2400

An asset management giant expects next year’s rate hike to push the yen to 130 against the dollar.

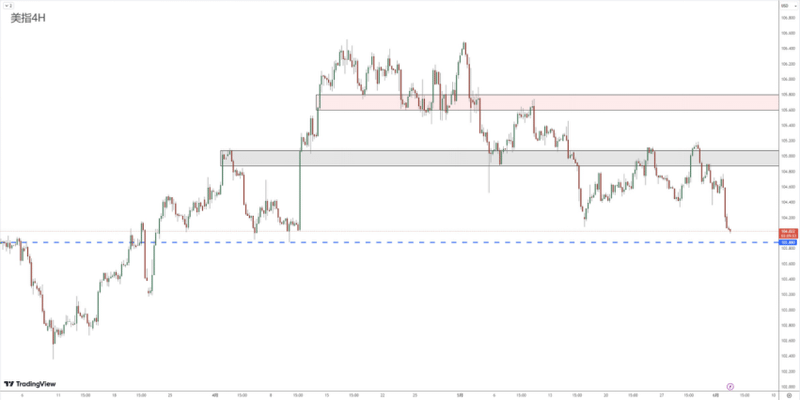

Hong Kong Hang Seng Index Futures (H4) Intraday: Exercise caution. (Third

Saxo Japan alters trading conditions.

A brief discussion on the principles and types of forex copy trading~

Bullock says the interest rate hike has boosted the Australian dollar's recovery